Figure 1

Figure 2

Team 15

Team Members |

Faculty Advisor |

Chloé Becquey |

Sheida Nabavi Sponsor L&T Info Tech (LTI) |

sponsored by

Climate Risk Strategy Analyzer

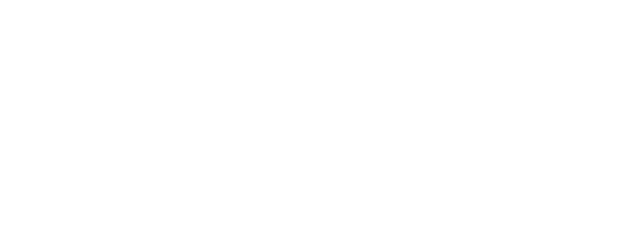

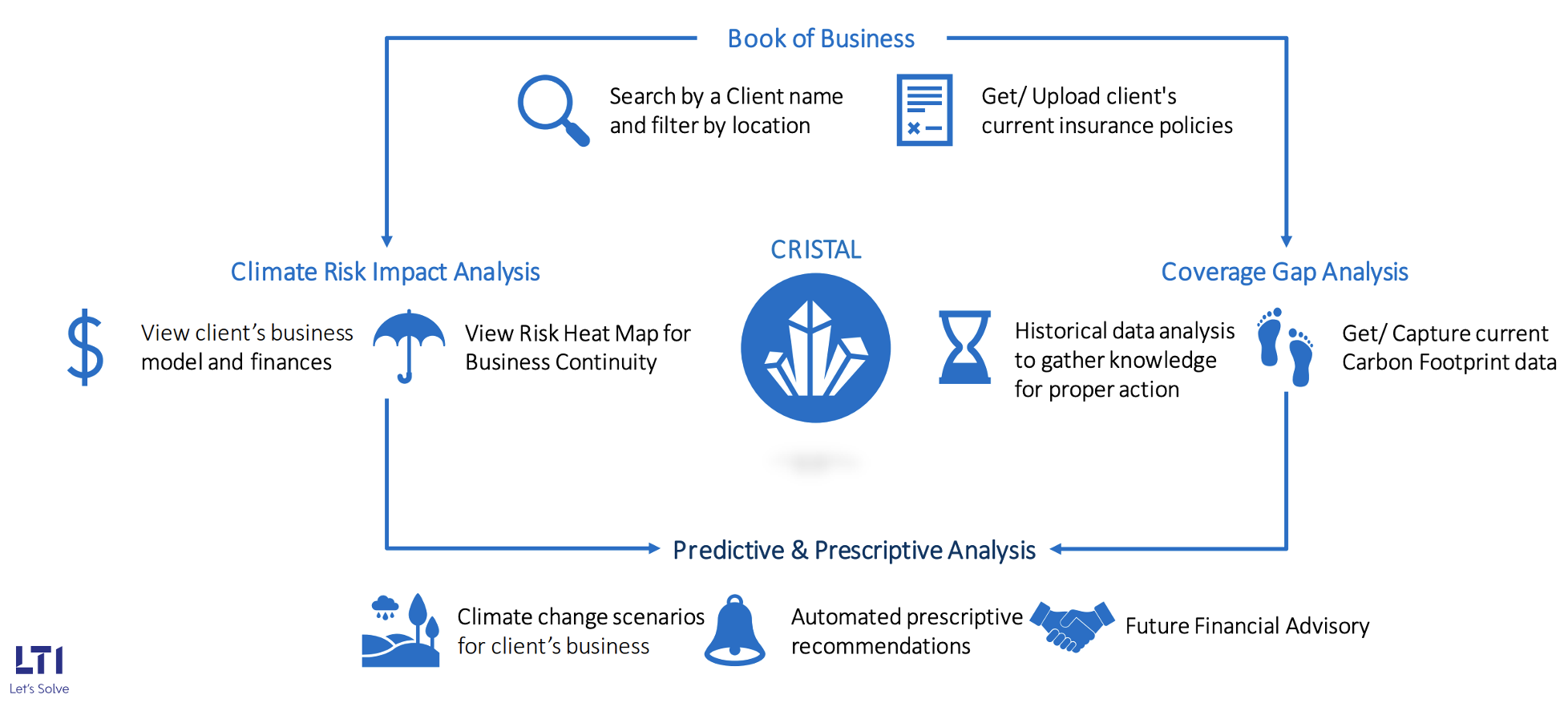

When climate disasters occur and damage properties, insurance companies are expected to pay for losses covered by a client’s policy. The issue, however, is that many of these policies are determined by historical data. This historical data determines how much an insurance company is expected to pay if a claim is made and under what circumstances a claim is valid. This past data is rapidly becoming more and more dissimilar to what is happening today due to changes in the frequency and severity of climate disasters. It is vital that better solutions are developed in order to reflect the current circumstances. It is for these reasons that the project Climate Risk Strategy Analyzer (CRISTAL) was created. The purpose of CRISTAL is to act as a tool for broker agencies to evaluate their clients current insurance policies and determine what further coverage may be needed when the current climate situation is taken into consideration. By combining a climate risk analysis and a coverage gap analysis, CRISTAL will provide users with predictive and prescriptive analyses. Such analyses will include possible climate events that can affect a client’s business, automated recommendations related to their policies, and advisories about potential financial changes. In order to achieve this goal, our aim is to implement three main features focused on flood events: a historic analysis of flood claims made in proximity to a given address, a simulation of a potential flood event, and a prediction of what damages may be incurred during such a flood event.